Diversify your banking services to gain more FDIC insurance.

Covercy offers commercial real estate investment firms secure, fee-free banking solutions provided by FDIC-insured banks — with features designed specifically for commercial real estate & real estate asset protection.

Covercy works with FDIC-insured banking partners to offer diversified alternatives

With the recent receivership of some banks, many commercial real estate owners and development firms are left searching for an alternative and evaluating real estate asset protection strategies. Enter Covercy, the first investment management software for commercial real estate professionals that connects to *FDIC-insured partner banks for high-interest earning deposits with total access and liquidity for added real estate asset protection, plus the instant creation of checking accounts organized under each real estate asset or property.

Covercy partners with Choice Financial Group. Founded in 1906 with a healthy and strong balance and an impressive growth track record, Choice is Covercy’s primary U.S. banking partner providing our customers FDIC-insured interest bearing checking accounts.

*Covercy is a technology company, does not hold your money and is not FDIC-insured.

.png)

Covercy is more than just an investor management platform.

Covercy has you covered for the entire deal lifecycle, from capital raise all the way through to pro-rata or waterfall modeling, including the actual transfer of distribution payments from asset account to investor account with the click of a button via ACH debit — no wire transfers, paper checks, or cumbersome NACHA files required. Covercy also gives commercial real estate sponsors access to robust reporting, document sharing, and investor communication tools.

The first banking-embedded investment management platform for commercial real estate.

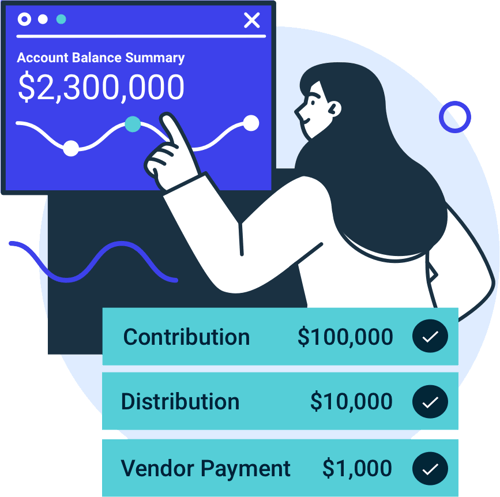

Do your banking right within the Covercy platform. Open and manage multiple high yield checking accounts per asset, import contributions, and distribute funds to investors with a single click.

Investor payment distributions, simplified.

Distribute payments directly into your investors’ bank accounts without leaving the platform. With Covercy, you can auto-calculate distributions based on pro-rata ownership or build completely customizable waterfall models and send money to your investors' bank accounts with a single click.

Collect contributions and distribute funds anywhere in the world.

Seamlessly perform domestic and cross-border capital calls and distributions from right within the platform. You can even offer your investors the ability to receive funds in the currency of their choice. All done automatically. (US transactions via ACH Debit)

Covercy has everything you need to power your real estate firm.

Try Covercy at your own pace. Sign up for a free trial today.

Banking provided by Choice Financial Group: Member FDIC.

*Actual formula for calculating APY: If your balance is between $120,000 and $1 million (Fed Funds Rate – 0.2%) * 48%. If your balance is between $1million and $15 million, you would earn (Fed Funds Rate – 0.2%) * 65%. The above APYs represent a Fed Fund Rate of 4.75% and are true as of Feb 1, 2023.